Upgrade changes to the MakeMoney EA

In the next few days we will be doing an upgrade to the MakeMoney EA. The Upgrade can be downloaded from the EAFactory website or directly from active MT4 charts by the 19th of September.

The MakeMoney EA is one of the highest producing and robust EA produced by Expert4x and EAFactory. One of the downsides of this EA is that it generally has a large drawdown in the course of building up to an attractive gain.

Most of the changes are designed to improve risk and transaction management.

There are 4 major changes discussed below.

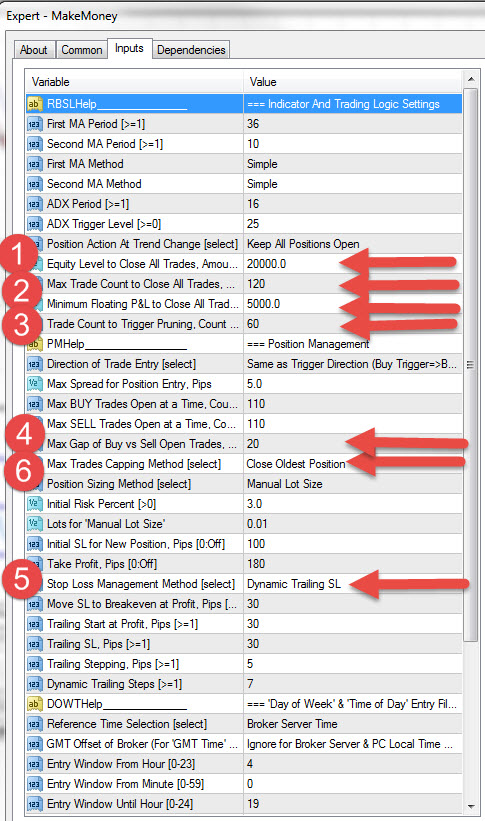

- Equity Levels to Close All Trades

- Maximum Trade Count to Close all trades

- Trade Count to Trigger Pruning

- Maximum Gap of open Buy and Sell trades

- Dynamic Trailing stop

- Maximum open deals management option

-

Equity Levels to Close All Trades

This setting allows a trader to stop trading when the trading profit is reached. So if the trader for instance starts with $10 000 and wants to stop trading when money has been doubled, the trader will set this for $20 000. When the account is doubled the EA will close all deals and stop trading. You can set the equity amount to be any amount.

This setting allows traders to lock in good profits and start trading again. This is especially handy if gains need to be withdrawn while there are no open deals.

-

Maximum Trade Count to Close all trades

This is almost the same as the previous setting but is based on open trades. So the settings would be for instance 100 open deals and $5 000 in profit. So when there are more than 100 open deals and the minimum open deal profit is $ 5 000 the EA will close all deals.

Again, this setting allows traders to lock in good profits and start trading again. This is especially handy if gains need to be withdrawn while there are no open deals.

-

Trade count to start pruning.

Pruning means that the EA will match a negative deal with a slightly positive deal and close both. The idea behind this setting is to reduce the number of open deals produced by the EA in a profitable way. So if set to 60 the EA will automatically close all negative deals it can match with deals with a bigger positive balance.

-

Maximum Gap of open Buy and Sell trades

Risk can increase tremendously when there is a big imbalance between open buys and open sells. If there are for instance 60 open buys and 20 open sells large losses can occur if the market goes into a sell phase when the EA is in a no trade period (this can happen with short timeframe settings).

So in the above example if this setting is set to 40 the EA will not open any more buys (as this increase the gap) but it will open more sells. When this setting is used the time of day setting do not work and trading occurs on a 24-hour basis. This is a nice hedge as profit will be good if the price goes into a buy phase as there are more buys than sell. If the market goes into a sell phase more sells will open reducing the number of unhedged buy trades.

This is possibly the best risk reduction technique implemented and was implemented successfully during the trading of option 2 on a manual basis.

-

The Dynamic Trailing stop

The Dynamic Trailing stop allows the trader to use a trailing stops update that will ensure that the same risk / return ratio is maintained. This Stop is described in this video.

-

Maximum open deals management option.

Previously when the maximum number of open deals were reached the EA continued opening new deals and then closed the oldest deal so that the number of open deals did not increase. Now the traders can choose whether to close the oldest deal or the most positive deal.

The upgrade will hopefully be made available to clients by the 19th of September.

The impact of these setting on profitability will depend on which currency, timeframe and settings you use. To test the impact on your Broker Account we suggest you optimise the EA without and then with the new settingsetting

Please use the comments facility below for make any comments or ask any questions about these upgrade settings.